VAT Treatments UAE

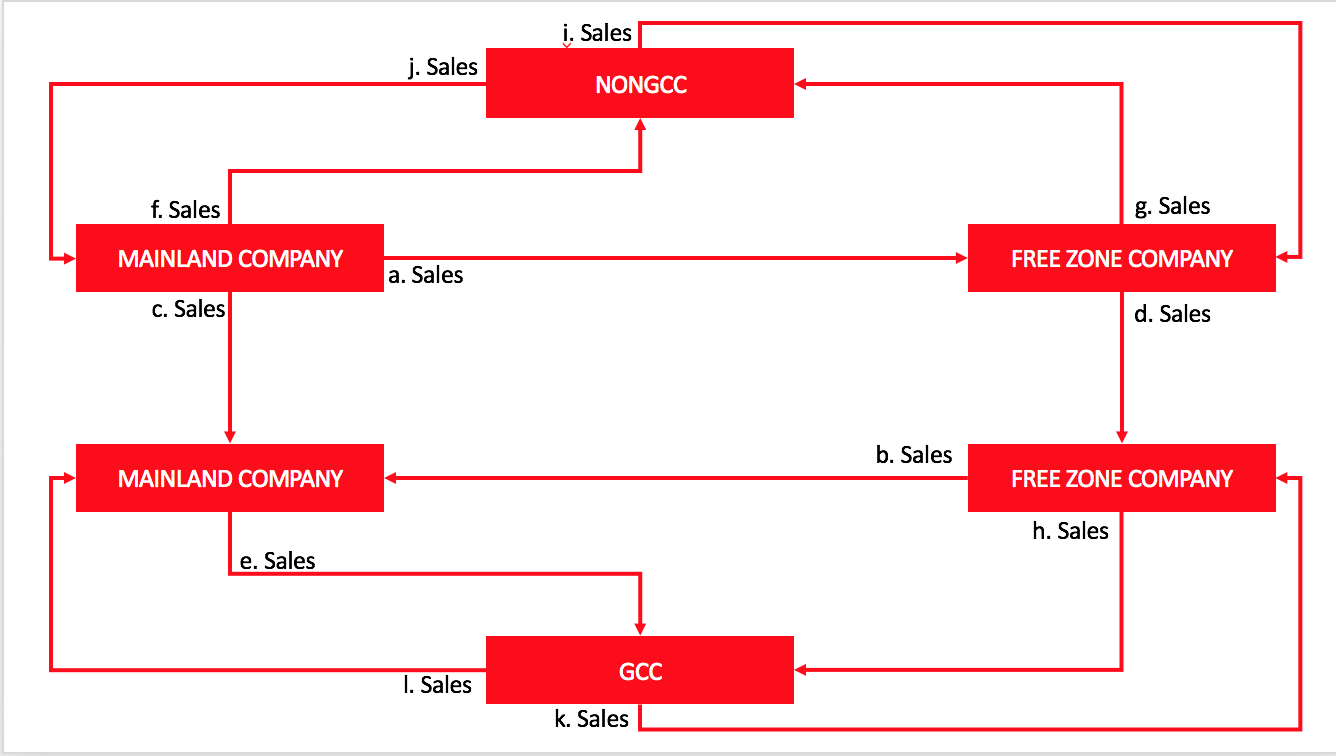

Illustration explains type transactions that can occur in UAE. Our article explains the VAT treatments to be adopted while implementing VAT for your organization based in UAE. Following information gives the basic overview on how VAT should be handled for mainland and freezone company. VAT treatment also varies based on nature of supply i.e. product or a service.

Supply of Products

Scenario a.

In this scenario Mainland company sells to free zone company. Main land company will charge 5% output VAT on sales whereas free zone company will record 5% input VAT on purchases.

Scenario b.

In this scenario Free Zone company sells to Mainland company. Free zone company will record 0% output on sales whereas mainland company will treat transaction as import and record purchases under reverse charge mechanism (RCM).

Scenario c.

In this scenario Mainland company sells to Mainland company. Seller will charge 5% output VAT while purchaser will record 5% input VAT.

Scenario d.

In this scenario Freezone company sells to Freezone company. Transaction is out of scope for VAT transactions and no VAT is required to be charged.

Scenario e.

In this scenario Mainland company sells to GCC Company for example company in KSA. In this case Mainland company will record 0% output VAT while company in KSA records transaction under Reverse Charge Mechanism (RCM)

Scenario f.

In this scenario Mainland company sells to Non GCC company for example company in UK. In this case Mainland company will record 0% output VAT while company in UK records transaction under their local tax law.

Scenario g.

In this scenario Freezone company sells to Non GCC company for example company in UK. In this case transaction is outside scope of VAT while company in UK records transaction under their local tax law.

Scenario h.

In this scenario Freezone company sells to GCC Company for example company in KSA. In this case transaction is outside scope of VAT while company in KSA records transaction under Reverse Charge Mechanism (RCM)

Scenario i.

In this scenario GCC based company sells to mainland company in UAE. In this case GCC company will record 0% Output while company in mainland will record purchase transaction under Reverse Charge Mechanism (RCM).

Scenario j.

In this scenario Non GCC based company sells to mainland company in UAE. In this case Non GCC company will record transaction as per their local law while mainland company based in UAE will record purchase transaction under Reverse Charge Mechanism (RCM).

Scenario k.

In this scenario GCC based company sells to Freezone company in UAE. In this case GCC company will record 0% Output while transaction is out of scope for company in Freezone.

Scenario l.

In this scenario GCC based company sells to mainland company in UAE. In this case GCC company will record 0% Output while company in mainland will record purchase transaction under Reverse Charge Mechanism (RCM).

Supply of Services

Scenario A.

In this scenario Mainland company sells to free zone company. Main land company will charge 5% output VAT on sales whereas free zone company will record 5% input VAT on purchases.

Scenario B.

In this scenario Free Zone company sells to Mainland company. Free zone company will record 5% output on sales whereas mainland company will will record 5% input VAT on purchases.

Scenario c.

In this scenario Mainland company sells to Mainland company. Seller will charge 5% output VAT while purchaser will record 5% input VAT.

Scenario D.

In this scenario Freezone company sells to Freezone company. Seller will charge 5% output VAT while purchaser will record 5% input VAT.

Scenario E.

In this scenario Mainland company sells to GCC Company for example company in KSA. In this case Mainland company will record 0% output VAT while company in KSA records transaction under Reverse Charge Mechanism (RCM)

Scenario F.

In this scenario Mainland company sells to Non GCC company for example company in UK. In this case Mainland company will record 0% output VAT while company in UK records transaction under their local tax law.

Scenario G.

In this scenario Freezone company sells to Non GCC company for example company in UK. In this case Freezone company will record 0% output VAT while company in UK records transaction under their local tax law..

Scenario H.

In this scenario Freezone company sells to GCC Company for example company in KSA. In this case Freezone company will record 0% output VAT while company in UK records transaction under their local tax law..

Scenario I.

In this scenario GCC based company sells to mainland company in UAE. In this case GCC company will record 0% Output while company in mainland will record purchase transaction under Reverse Charge Mechanism (RCM).

Scenario J.

In this scenario Non GCC based company sells to mainland company in UAE. In this case Non GCC company will record transaction as per their local law while mainland company based in UAE will record purchase transaction under Reverse Charge Mechanism (RCM).

Scenario K.

In this scenario GCC based company sells to Freezone company in UAE. In this case GCC company will record 0% Output while Freezone company based in UAE will record purchase transaction under Reverse Charge Mechanism (RCM).

Scenario L.

In this scenario GCC based company sells to mainland company in UAE. In this case GCC company will record 0% Output while Freezone company based in UAE will record purchase transaction under Reverse Charge Mechanism (RCM).

Get your ERP updated with correct configuration, do let us know in case you require any assistance at info@techventures.ae or book your self free VAT session.