Microsoft Dynamics 365 Post-dated Cheque

Tech Ventures’ Post-Dated Cheques (PDC) Extension for Microsoft Dynamics 365 Business Central provides a seamless solution for managing post-dated cheque transactions, ensuring financial accuracy and control. This add-on enables businesses to efficiently track, collect, issue, and clear PDCs, eliminating the risks of manual errors and missed payments.

With automated status updates, real-time tracking, and detailed reporting, the extension helps businesses streamline financial commitments, optimize cash flow, and maintain compliance with accounting best practices. Whether managing vendor payments or customer collections, this solution ensures greater visibility, efficiency, and control over post-dated cheque transactions.

Microsoft Dynamics 365 Business Central Post-dated Cheque Key Features

PDC Transactions for Collection

Tracking and collecting post-dated cheques from customers manually can lead to missed payments and financial discrepancies. The system records post-dated cheque transactions and allows users to efficiently manage the collection process, ensuring all payments are properly tracked and recorded.

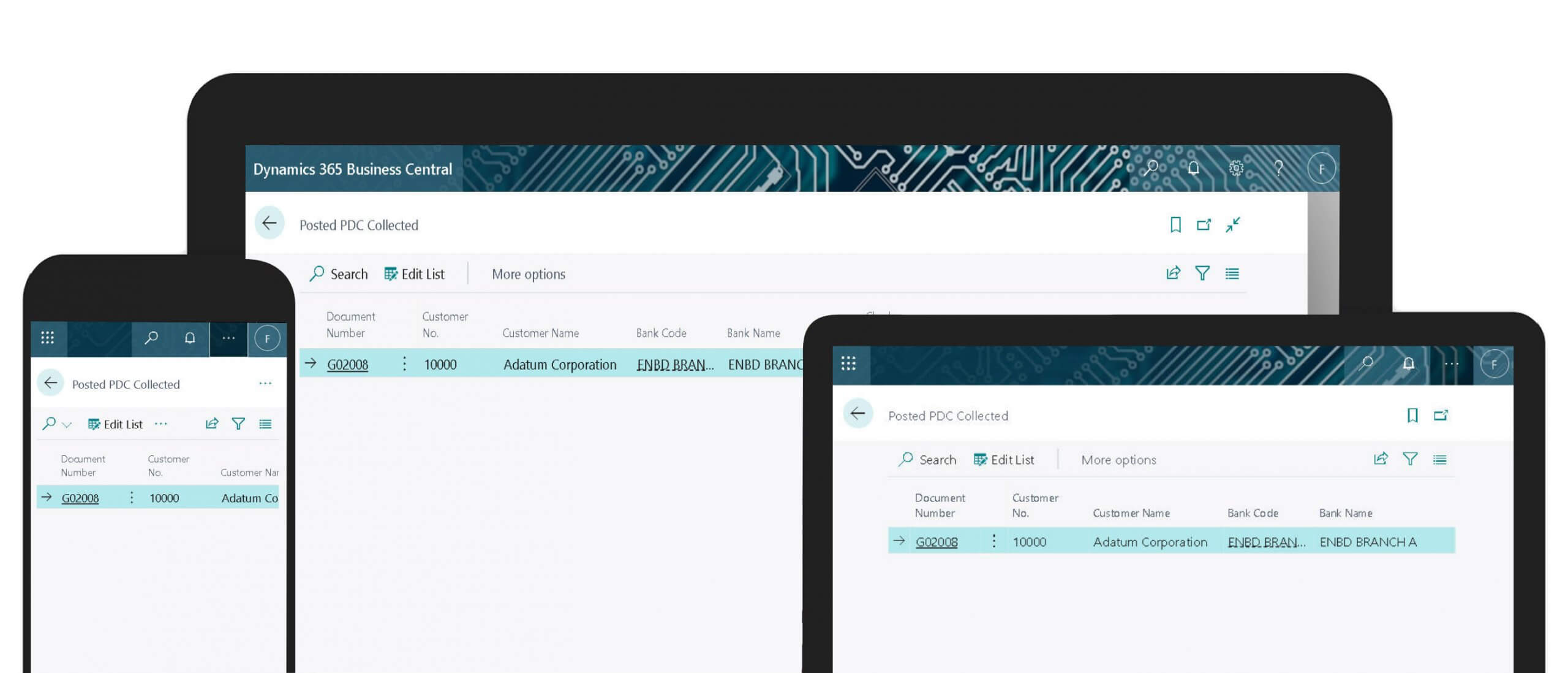

PDC Collected List Page

Businesses often lack a centralized view of all collected post-dated cheques, making it difficult to manage financial commitments. A dedicated list page displays all collected PDCs, including key details such as posting date, PDC date, customer name, amount, and status. Users can take actions such as depositing, clearing, or rejecting cheques directly from this interface.

PDC Collected Matured

Identifying which post-dated cheques are ready for processing can be challenging, leading to delays and inefficiencies. The system automatically highlights matured cheques in green and updates their status from ‘Received’ to ‘Mature,’ enabling users to take the next necessary actions promptly.

Cleared & Posted PDC Collected List

Without a structured record, tracking successfully collected and posted PDC transactions can become chaotic. A dedicated list keeps track of all cleared and posted PDCs, providing a detailed financial record with essential transaction details for easy reconciliation.

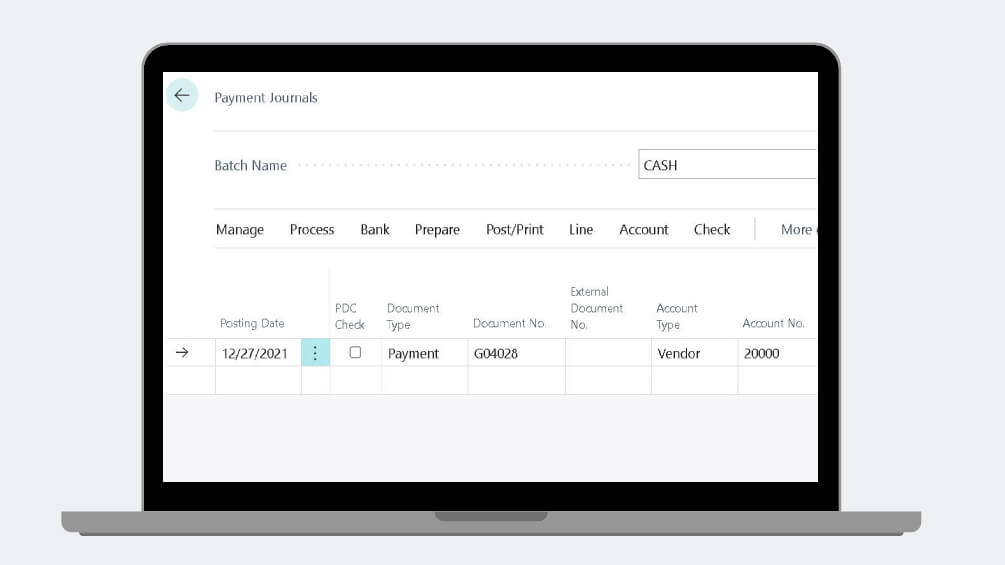

PDC Transactions for Issuance

Managing outgoing post-dated cheques for vendors manually can result in missed or delayed payments. The system enables users to efficiently issue post-dated cheques to vendors, ensuring timely payments and better vendor relationship management.

PDC Issued List Page

Businesses need real-time visibility into issued PDCs to track payment commitments. A comprehensive list displays all issued PDCs along with posting date, PDC date, vendor name, amount, and status, allowing users to monitor their financial obligations effectively.

PDC Issued Matured

Keeping track of when issued post-dated cheques mature can be a challenge, leading to potential late payments or financial mismanagement. The system automatically updates the status of issued PDCs from ‘Received’ to ‘Mature’ and highlights them in green, notifying users to process payments accordingly.

Cleared & Posted PDC Issued List Page

Businesses need a structured record of all issued post-dated cheques for audit and reconciliation purposes. A dedicated list provides an overview of successfully issued, posted, and cleared PDC transactions, helping businesses maintain financial transparency and accuracy.

Why Choose Our Post-Dated Cheque?

Automated Tracking & Status Updates:

Say goodbye to manual tracking. The system automatically updates the status of collected and issued PDCs, ensuring you never miss a payment or deposit deadline.

Real-Time Financial Visibility:

Gain complete visibility over all PDC transactions through dedicated list pages, allowing finance teams to track collections, clearances, and maturities effortlessly.

Error-Free & Secure Transactions:

Minimize risks associated with human errors, misplaced cheques, or delayed clearances. The system ensures that all PDCs are securely recorded and processed.

Enhanced Cash Flow Management:

By accurately tracking upcoming payments and collections, businesses can forecast cash flow more effectively and avoid liquidity issues.